Top 3 Takeaways from Profit First

Since The Green Executive® has started Profit First implementation, we’ve come to learn three things:

- Financial accountability is a must!

- A Profit and loss statement doesn’t mean shit.

- Mindset is everything.

Once you can wrap your mind around these three things, your business begins to take shape in a whole new way and you go from:

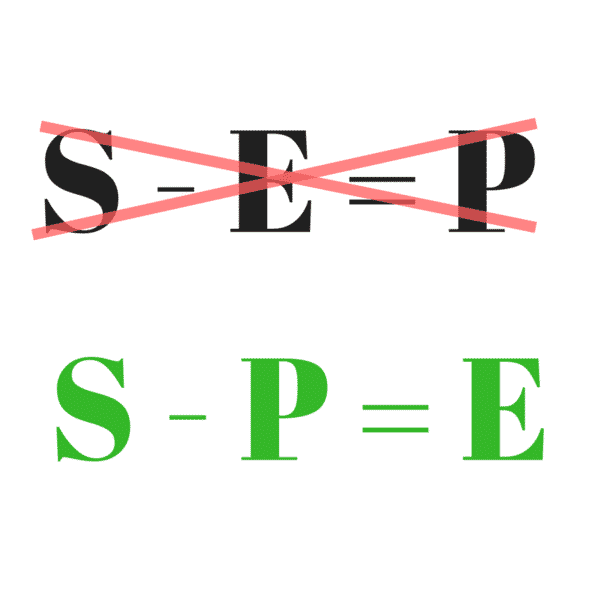

Sales – Expenses = Profit to…

Sales – Profit = Expenses

Let me explain….

Financial Accountability

No one can hold you accountable for you business finances but you. Profit First is all about HOW you spend the money you make. In order to implement Profit First into our business, we had to restructure how money moved in our business. Think of the envelope system (you’ve heard of this system right?), when you cash your pay check you put X amount of money into each labeled envelope – mortgage, savings, groceries, household needs, etc. – then you limit your spending for each item based on the amount of money in the envelope. The Profit First method is no different. You’re creating bank accounts and depositing money into each account so that you know exactly what you have to allocate to that expense. AND in doing so, you are holding you and your whole company accountable for your expenses.

Hot Tip: Keep your personal finances separate from your business finances. This is a common misstep in both large and small businesses, so take the extra steps/measures you need to take to ensure that “co-mingling” of your personals finances and business finances don’t happen.

Profit and Loss Statement

Since Profit First is a cash based way of doing business, you have to understand your balance sheet and all the debt you owe not just your profit and loss statement. We learned early on while implementing the Profit First method in our business that our P&L statement didn’t mean shit. It was our P&L statement + what we owe + our balance sheet that really gave us a full glimpse into what we were spending in our business.

Once you understand what you owe, you can truly allocate your money where it needs to go verses where you “think” it needs to go.

Mindset Shift

When you first start implementing the Profit First method in your business, the biggest struggle you’re going to have is changing the way you make spending decisions within your business. It was one of the hardest for us.

One of the most common questions we get asked is, “Why so many bank accounts?” Simple, these are the envelopes in your business. Once you learn how to allocate the right amount of money in the appropriate envelopes, then you’ll know what you have to spend when the time comes.

As with all things, mindset is everything, so only you can decide if you are ready to take a step toward financial freedom through the Profit First method.

Pro Tip: Start small with a drip account. A seasonal drip account allows you to squirrel away money into a separate bank account so that it’s there from December through February (the slow months) or whenever you need it.

Look, The Green Executive® knows it’s a HUGE decision to start implementing something new in your business that you don’t fully understand or even know where to start. That’s why we’ve designed a brand new e-book to help guide you on our journey and give you a deeper look into how Profit First works and how TGE can help you get started today.

What do you say? Book a FREE consultation and lets get you on the path to financial freedom in your lawn care and landscaping business!